Life Insurance in and around Pittsburg

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Pittsburg

- Brentwood

- Antioch

- Bay Point

- Knightson

State Farm Offers Life Insurance Options, Too

No one likes to fixate on death. But taking the time now to secure a life insurance policy with State Farm is a way to demonstrate love to the people you're closest to if you pass.

State Farm can help insure you and your loved ones

Don't delay your search for Life insurance

Life Insurance Options To Fit Your Needs

Having the right life insurance coverage can help loss be a bit less overwhelming for the ones you hold dear and give time to recover. It can also help cover bills and other expenses like car payments, future savings and utility bills.

Don’t let worries about your future keep you up at night. Reach out to State Farm Agent Jeff Chaput today and learn more about how you can rest easy with State Farm life insurance.

Have More Questions About Life Insurance?

Call Jeff at (833) 806-0168 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

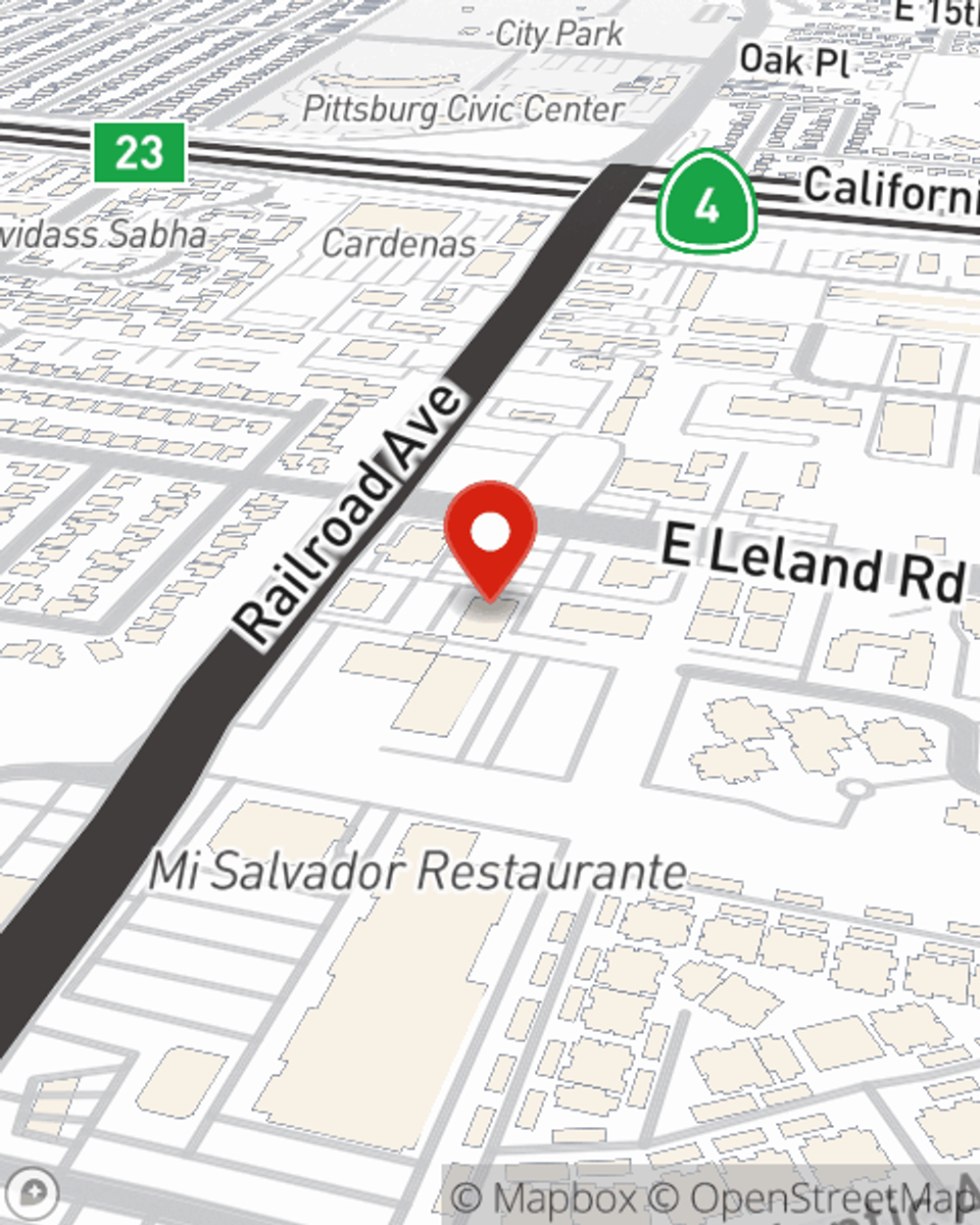

Jeff Chaput

State Farm® Insurance AgentSimple Insights®

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.